To help improve your financial situation, you might consider reducing your debt. Before starting any debt payoff strategy (or combination of strategies), be sure you understand the terms of your debts, including interest rates, payment requirements, and any prepayment or other penalties.

Start with Understanding Minimum Payments

You are generally required to make minimum payments on your debt, based on factors set by the lender. Failure to make the minimum payments can result in penalties, higher interest rates, and default. If you make only the minimum payments, it may take a long time to pay off the debt, and you will have to pay more interest over the life of the loan. This is especially true of credit-card debt.

Your credit-card statement will indicate your current monthly minimum payment. To find the factors used in calculating the minimum payment amount each month, you can review terms in your credit-card contract, which can change over time.

The minimum payment for credit cards is usually equal to the greater of a minimum percentage multiplied by the card’s balance (plus interest on the balance, in some cases) or a base minimum amount (such as $15). For example, assume you have a credit card with a current balance of $2,000, an interest rate of 18%, a minimum percentage of 2% plus interest, and a base minimum amount of $15. The initial minimum payment required would be $70 [greater of ($2,000 x 2%) + ($2,000 x (18% ÷ 12)) or $15]. If you made only the minimum payments (as recalculated each month), it would take 114 months (almost 10 years) to pay off the debt, and you would pay total interest of $1,314. For consumer loans, the minimum payment is generally the same as the regular monthly payment.

Make Additional Payments

Making payments in addition to your regular or minimum payments can reduce the time it takes to pay off your debt and the total interest paid. Additional payments could be made periodically, such as monthly, quarterly, or annually.

Using the previous example ($70 initial minimum payment), if you made monthly payments of $100 on the credit card debt, it would take only 24 months to pay off the debt, and total interest would be just $396.

Here’s another example. Assume you have a current mortgage balance of $300,000. The interest rate is 5%, the monthly payment is $2,372, and the remaining term is 15 years. If you make regular payments, you will pay total interest of $127,029. However, if you pay an additional $400 each month, it will take only 12 years and one month to pay off the mortgage, and you will pay total interest of just $99,675.

Pay Off Highest Interest-Rate Debt First

One way to potentially optimize payment of your debt is to first make the minimum payments required for each debt and then allocate any remaining dollars to debt with the highest interest rates.

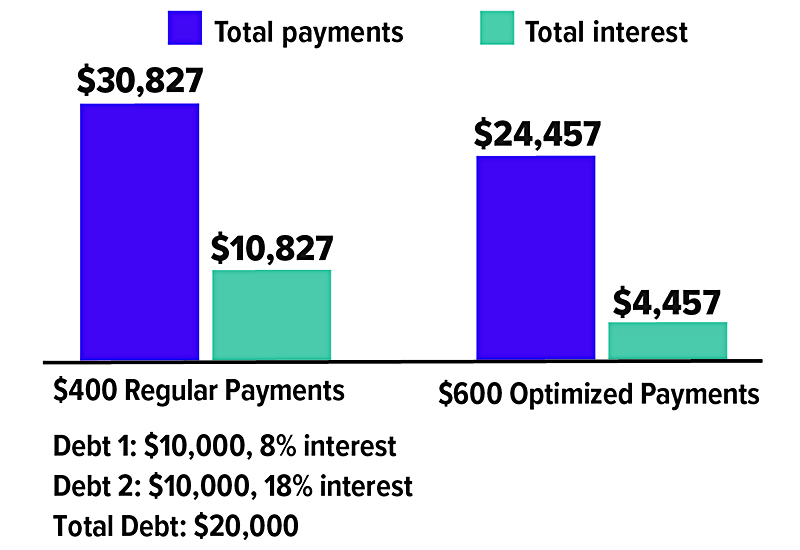

For example, assume you have two debts, you owe $10,000 on each, and each has a monthly payment of $200. The interest rate for one debt is 8%; the interest rate for the other is 18%. If you make regular payments of $400, it will take 94 months until both debts are paid off, and you will pay total interest of $10,827. However, if you make monthly payments of $600, with the extra $200 paying off the debt with an 18% interest rate first, it will take only 41 months to pay off the debts, and total interest will be just $4,457.

Pay Off Highest Interest-Rate Debt First

Use a Debt-Consolidation Loan

If you have multiple debts with high interest rates, it may be possible to pay them off with a debt-consolidation loan. Typically, this will be a home-equity loan with a lower interest rate than the rates on the debts being consolidated. (Note that a federal income tax deduction is not currently allowed for interest on home-equity indebtedness unless it is used to substantially improve your home.) Keep in mind that a home equity-loan potentially puts your home at risk because it serves as collateral, and the lender could foreclose if you fail to repay. There also may be closing costs and other charges associated with the loan.

All examples are hypothetical and used for illustrative purposes only and do not represent any specific investments or products. Fixed interest rates and payment terms are shown, but actual interest rates and payment terms may change over time. Actual results will vary.

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2023.