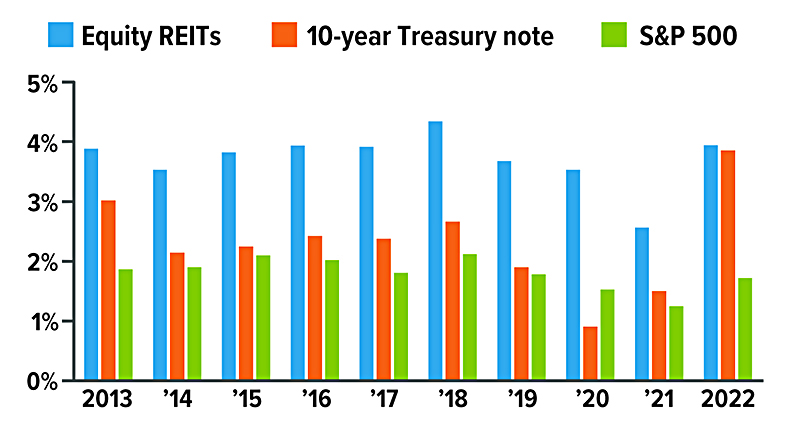

Real estate investment trusts (REITs) can offer a consistent income stream that is typically higher than Treasury yields and other stock dividends (see chart).

A qualified REIT must pay at least 90% of its taxable income each year as shareholder dividends, and unlike many companies, REITs generally do not retain earnings, which is why they provide higher dividend yields than most other stock investments. You can buy shares in individual REITs, just as you might buy shares in any publicly traded company, or you can invest through mutual funds and exchange-traded funds (ETFs).

Share Price Volatility

While REITs may offer solid dividends, share prices tend to be volatile and are especially sensitive to rising interest rates. The most common type of REIT is an equity REIT, which uses capital from a large number of investors to buy and manage residential, commercial, and industrial income properties. These REITs derive most of their income from rents and may be directly affected by rising rates, because companies often depend on debt to acquire rent-producing properties — and higher rates can push real estate values downward. Also, as interest rates rise, REIT dividends may appear less appealing to investors relative to the stability of bonds offering similar yields.

Considering these factors, it’s not surprising that equity REIT shares struggled in 2022 — declining 25% in total returns — as the Federal Reserve raised rates to combat inflation. However, REITs soared in 2021, returning 41%, and may be poised for better performance in 2023 and beyond, as interest rates settle. In Q1 2023, REIT fundamentals such as funds from operation and net operating income were solid, and occupancy rates for industrial and retail properties surpassed pre-pandemic levels. (Apartment occupancy was down slightly, and office occupancy was still about 5% lower than before the pandemic.)1

Diversification and Asset Allocation

Along with providing income, REITs can be a helpful tool to increase diversification and broaden asset allocation, because REIT shares do not always follow the movements of stocks or bonds. Over the 10-year period ending in 2022, equity REITs had a correlation of 72% with the S&P 500 and 50% with the corporate and government bond market. The correlation was even lower over 30 years.2 As this suggests, REITs are in some respects a unique asset class. Diversification and asset allocation are methods used to help manage investment risk; they do not guarantee a profit or protect against investment loss.

Consistent Yields

Over the last decade, equity REITs maintained dividend yields that were higher than yields on the 10-year Treasury note and dividend yields on stocks in the S&P 500.

Real Estate Risks

There are inherent risks associated with real estate investments and the real estate industry that could adversely affect the financial performance and value of a real estate investment. Some of these risks include a deterioration in national, regional, and local economies; tenant defaults; local real estate conditions, such as an oversupply of, or a reduction in demand for, rental space; property mismanagement; changes in operating costs and expenses, including increasing insurance costs, energy prices, real estate taxes, and the costs of compliance with laws, regulations, and government policies.

The return and principal value of all investments fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. Investments seeking to achieve higher yields also involve a higher degree of risk.

Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1–2) National Association of Real Estate Investment Trusts, 2023

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2023.