With home values skyrocketing recently, your home may be one of your largest assets. Using home equity to help finance other financial objectives is a strategy many people consider, but before doing so be sure you understand the risks as well as the potential benefits.

Home equity is the difference between how much your home is worth, based on current market conditions, minus your mortgage balance. Let’s say your home is worth $450,000 in the current market and your outstanding mortgage is $250,000. That means you have $200,000 in equity.

In most cases, lenders will allow you to borrow up to 80% of your home’s value minus your mortgage balance. In the example above, the total amount you might borrow would be $110,000 (assuming you qualify).

It’s probably best to be as conservative as possible when using home equity. There’s no guarantee that your home will maintain its current market value, so you could end up owing more than it’s worth. Moreover, in the unfortunate event of default, you could lose your house.

How to Access Home Equity

Generally, there are three ways to access home equity:

1. Cash-out refinance: In a cash-out refinance, you would refinance your mortgage for more than what you owe and take the difference in cash.

2. Home equity loan: With this type of loan, you would leave your current mortgage untouched and take out a separate loan against the equity in your home, with a fixed interest rate and fixed monthly payments.

3. Home equity line of credit: A HELOC works much like a credit card. You apply for a revolving credit amount up to a certain limit and, upon approval, have access to that money for a specific period, known as the draw period (usually 10 years). HELOC funds don’t all have to be used right away or at the same time. You can usually access the funds as needed by writing a check or using a linked credit card. Interest rates are variable; required payments will depend on how much you borrow and the prevailing rate. When the draw period ends, all outstanding balances need to be repaid.

Keep in mind that each of these options will have specific fees, including appraisal fees. A refinance could also require closing costs, which can equal thousands of dollars, depending on the amount borrowed.

The best type of loan will depend on your specific situation. If you need a fixed amount of money, a cash-out refinance or home equity loan might be appropriate. If you need an indeterminate amount over time or seek an emergency cash reserve, a HELOC might better serve your needs.

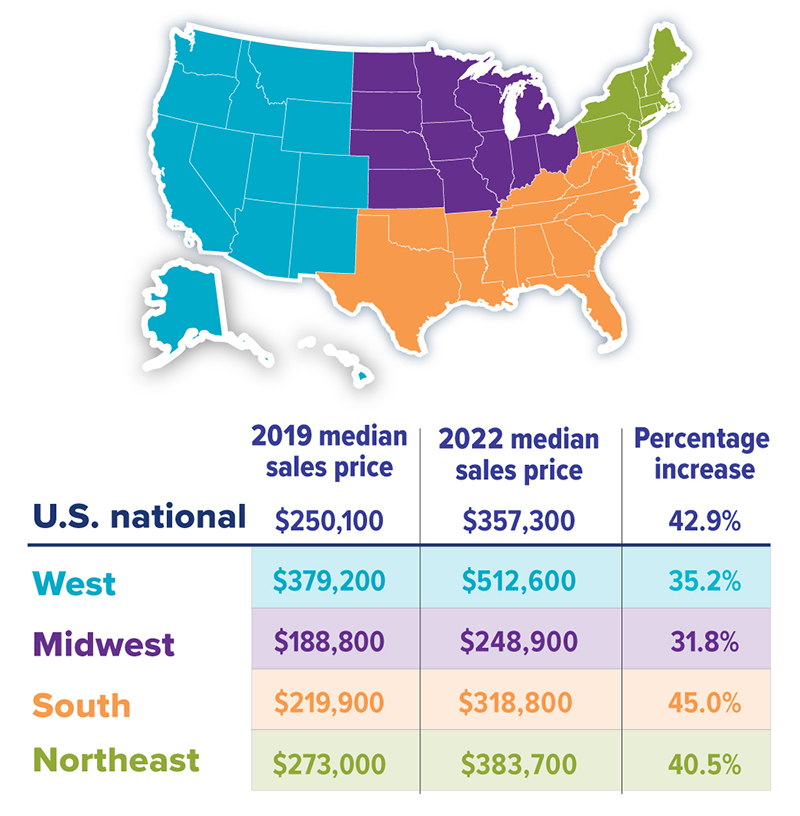

Growth in Home Sales Prices Since 2019

When Using Home Equity Might Make Sense

Because you’re putting your home at risk, it’s important to think critically and strategically when using home equity. Are you using the funds in a way that could reap future financial benefits, such as home repairs and improvements, helping to pay for a child’s college education, or consolidating high-interest debt? Then it might make sense. (A loan used for home repairs may also offer tax benefits; talk to a tax professional.) On the other hand, it might not be in your best financial interest if you’re thinking of using the money to fund an extravagant purchase, such as an expensive vacation or new luxury car.

Home equity loans and lines of credit that are not used to buy, build, or substantially improve your primary home (or a second home) are considered home equity debt; you cannot deduct the interest on home equity debt. With a cash-out refinance, you can only deduct interest on the new loan if you use the cash to make a capital improvement on your property.

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2022.