|

July 17, 2025 |

||

|

For nearly nine decades, Social Security has served as a cornerstone government benefit program for American retirees. With demographic shifts and an aging population, questions about the program’s long-term viability have become increasingly prominent. However, Social Security represents just one element of comprehensive retirement planning. Given today’s economic and political landscape, gaining a thorough understanding of all retirement planning components is essential for achieving lasting financial security. Regardless of whether retirement is approaching soon or still years away, learning how Social Security integrates with your broader financial strategy is crucial. To properly assess both potential benefits and risks, one must examine the program’s origins, present-day obstacles, and available approaches for managing future uncertainties. Social Security’s historical foundation

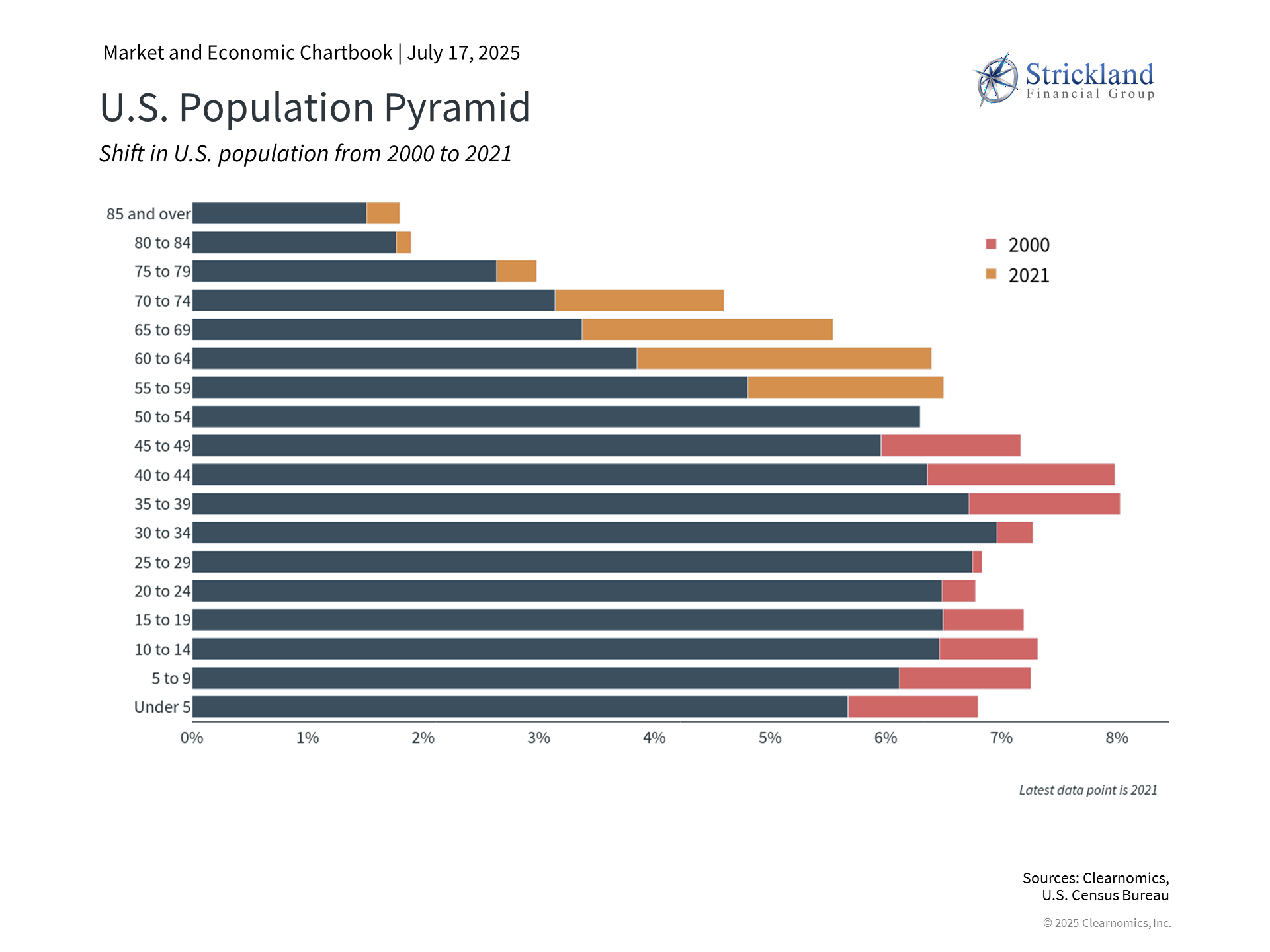

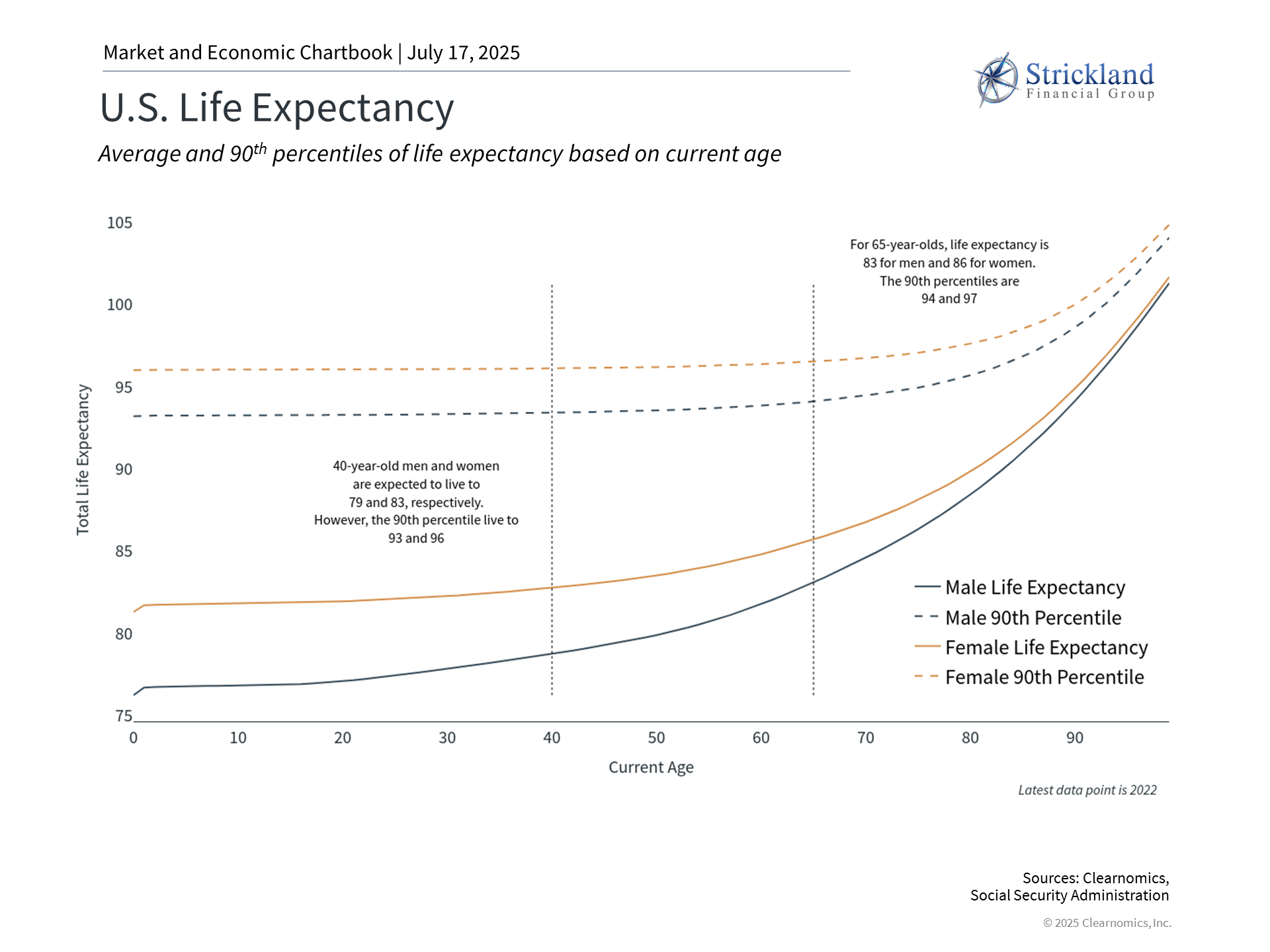

Created in 1935 during the Great Depression under President Franklin D. Roosevelt’s administration, Social Security originated as a protective framework for America’s elderly population. The program has transformed from its modest beginnings serving a limited population into an intricate system supporting millions of retired individuals, disabled workers, and their dependents. Currently, Social Security payments constitute a substantial component of retirement income for countless Americans. What obstacles does Social Security face in the current era? The program functions mainly through a pay-as-you-go structure, where today’s worker contributions fund today’s benefit payments. Put simply, the payroll contributions you make don’t accumulate for your future benefits but instead support current recipients’ monthly payments. This framework functioned effectively when worker-to-beneficiary ratios remained favorable throughout most of the 20th century. Nevertheless, population changes have resulted in fewer contributing workers while simultaneously increasing the number of benefit recipients. To illustrate, 1940 saw 42 workers supporting each retiree, while today’s ratio has dropped to approximately 2.8 workers per beneficiary, with further decline anticipated as aging demographics and declining birth rates continue. Numerous forecasts have attempted to predict when Social Security trust funds will reach depletion. The most recent assessment from the Social Security Board of Trustees indicates reserves will last until 2034, beyond which benefit reductions would become necessary. Currently, continuing payroll contributions would still fund roughly 78% of planned benefits. Although specific timelines may vary, the fundamental issue persists: absent significant reforms, trust funds may prove insufficient to maintain full scheduled benefits over the long term. Increased longevity benefits individuals but strains the Social Security trust fund

The national debt approaching $37 trillion and ongoing budget deficits compound concerns about program sustainability. Despite Social Security’s “mandatory” classification, mounting pressure to reduce government expenditures creates uncertainty regarding potential Congressional modifications to these programs. Understandably, potential remedies generate significant political controversy, making immediate Social Security fixes improbable. Proposed solutions encompass raising benefit eligibility ages, expanding the taxable wage ceiling, and enhancing fraud prevention measures. Regrettably, comprehensive long-term solutions for permanently resolving Social Security’s challenges remain limited. Examining other developed countries confronting similar demographic pressures offers valuable insights. Multiple European nations, including France and the UK, have raised retirement ages to alleviate system pressures. Australia has implemented an alternative “means-tested” approach, providing benefits only to retirees meeting specific asset and income criteria. While the projected 2034 depletion timeline remains several years distant, the urgency for solutions will continue mounting. Complete benefit elimination appears highly improbable, though Social Security’s persistent funding difficulties will likely necessitate program adjustments. Retirement Planning Strategic Considerations Regarding individual actions, thoughtful planning becomes essential for maintaining retirement progress given Social Security uncertainties. Appropriate decisions depend on your comprehensive financial plan, objectives, tax circumstances, and additional factors. Consider these significant elements:

Retirement benefits become available at age 62, though early claiming reduces monthly payments. Alternatively, postponing benefits until age 70 can boost monthly payments by roughly 8% annually beyond full retirement age (66-67, based on birth year), per Social Security Administration guidelines. Breakeven calculations can determine whether delaying represents a beneficial approach. Typically, surviving beyond the early 80s makes benefit delay advantageous for lifetime payment totals. However, this analysis shifts when considering money’s time value or opportunity costs.

Delaying benefits’ value depends significantly on income sources during the waiting period. Some retirees utilize portfolio distributions as a “bridge” toward enhanced Social Security payments later. This approach proves particularly beneficial for married couples, where maximizing the higher earner’s benefit establishes larger survivor benefits.

Social Security benefits may be taxable up to 85%, depending on combined income levels. Future tax legislation could potentially raise this percentage. Strategic withdrawal planning with qualified advisor assistance can help reduce benefit taxation impact.

Individuals earlier in their careers possess more retirement preparation time and greater adjustment flexibility regarding Social Security uncertainty. Therefore, younger workers might consider developing retirement plans with minimal Social Security dependence. This approach doesn’t mean completely disregarding potential benefits, but rather viewing them as personal savings supplements rather than primary foundations.

Policy modifications will likely emerge before trust fund depletion occurs. Remaining informed about proposed reforms enables appropriate planning adjustments. Potential changes include additional full retirement age increases, benefit formula modifications, or payroll tax cap alterations.

Given Social Security’s uncertain future, maximizing 401(k), IRA, and HSA contributions gains increased importance. These accounts offer tax benefits that can help offset potentially diminished government benefits. Social Security’s Future Demands Thoughtful Planning Despite valid concerns, maintaining proper perspective remains important. Social Security has previously navigated funding challenges, and political motivation to preserve the program continues strongly. The sensible approach involves neither unconditional trust nor complete dismissal of Social Security’s retirement planning role. Instead, investors should acknowledge the program’s significance while considering it as merely one element of a diversified retirement approach. The bottom line? Understanding Social Security’s challenges enables you to construct a more robust retirement strategy, regardless of your current age or professional phase. |

||

|

Securities offered through OSAIC WEALTH INC. Member FINRA/SIPC. Advisory services offered through S&S WEALTH MANAGEMENT, LP. A REGISTERED INVESTMENT ADVISOR. Main Branch Office/RIA Address: 2505 N. Hwy 360, Suite 490, Grand Prairie, TX 75050 | 817-276-8090 / 888-258-8258. Second Branch Office: 800 E. Border St., Ste. 200, Arlington, TX 76010 | 817-461-4412 / 877-615-7526. OSAIC WEALTH is separately owned and other entities and/or marketing names, products or services referenced here are independent of OSAIC WEALTH. STRICKLAND FINANCIAL GROUP, LLC is not affiliated with S&S WEALTH MANAGEMENT, LP. Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

|