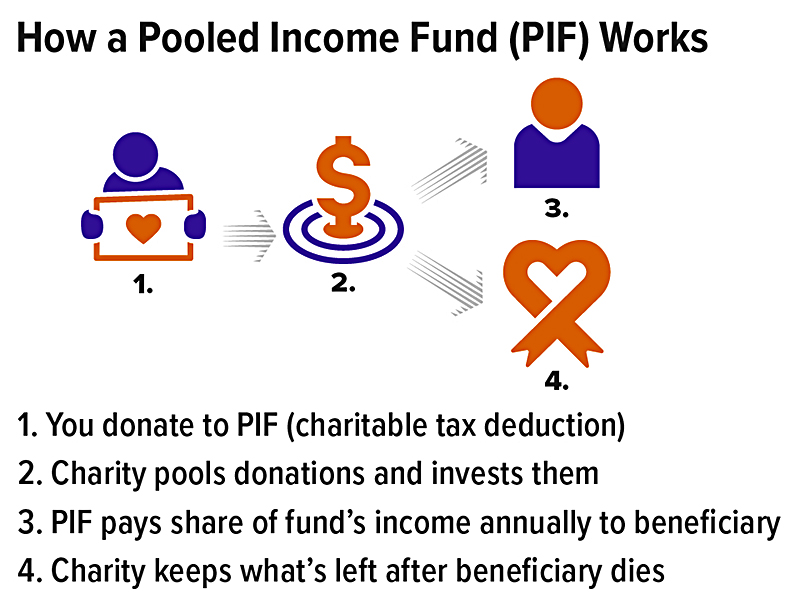

A pooled income fund is a trust with both charitable and noncharitable beneficiaries. It is established and run by a public charity, not by you. The charity “pools” the irrevocable contributions of many people, invests the money, and then distributes to you (or your designated beneficiary) a periodic income payment (usually quarterly or annually) for life, prorated to match your contribution to the fund. When you die or your designated beneficiary dies, your remaining share in the fund passes to the charity.

Charitable Deduction

If you itemize deductions, you receive an immediate federal income tax charitable deduction for the present value of the remainder interest that will pass to charity. Your deduction is limited to 50% or 30% of your adjusted gross income (AGI), depending on the type of property contributed. Amounts disallowed because of the AGI limitations can be carried over for up to five years, subject to the AGI limitations in the carryover years. The transfer of the remainder interest to charity would also qualify for the federal gift tax or estate tax charitable deduction.

The amount of the income tax deduction is generally based on the fair market value of the property contributed to the pooled income fund, the beneficiary or beneficiaries’ age(s), and the fund’s highest rate of return in the last three taxable years.

Noncharitable Income Interest

Trust payments can last for the life or lives of one or more noncharitable beneficiaries. For example, you could name yourself, yourself and your spouse, or even someone else as the noncharitable beneficiary.

If you retain a noncharitable interest, the pooled income fund interest will be included in your gross estate for federal estate tax purposes. If your spouse receives the noncharitable interest as your survivor, that interest should qualify for the estate tax marital deduction (and the balance should qualify for the estate tax charitable deduction).

If you transfer a noncharitable interest to someone else while you are alive, you may have made a gift or generation-skipping transfer (GST) to that person of the income interest. (A GST is a transfer to a person two or more generations younger than you.) A portion of the gift may qualify for the annual gift tax exclusion, but not for the GST tax annual exclusion. A transfer to your spouse would generally qualify for the gift tax marital deduction. You may also have a federal gift and estate tax applicable exclusion amount or a GST tax exemption to shelter any transfer from tax.

Donors generally have limited choices in investment strategy. The amount of income received by the noncharitable beneficiary is not guaranteed; it may increase or decrease depending on the performance of the fund. If the investments in the fund perform poorly and the actual income earned by the fund declines, the charity is prohibited from invading the principal to increase the payment to the noncharitable beneficiary.

Income distributed to the noncharitable beneficiary is usually taxable at ordinary income tax rates. It may also be subject to the 3.8% net investment income tax.

Other Considerations

One of the biggest advantages of choosing a pooled income fund over a charitable remainder unitrust or charitable remainder annuity trust is that you avoid the hassle and cost of establishing your own trust. Another advantage is that if the property you are donating to charity is relatively small, a pooled income fund makes the most of your assets by commingling them with the property of others. The fund can then use the increased assets to diversify among investments, thus helping reduce your investment risk. Also, the large size of the fund (compared to your own charitable trust) may translate into lower operating costs and more experienced management. By contrast, it may not be economically feasible for you to establish a charitable trust with a small investment. Even if you do, it may be impossible for the trustee to spread this money over a variety of investments. (Diversification does not guarantee a profit or protect against investment loss.)

In general, you can donate any type of property to a pooled income fund that the charity is willing to accept. A noncash donation will generally cause the 30% AGI limitation to apply to your charitable deduction. A fund cannot accept or hold tax-exempt securities.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2022.