It’s difficult to reach a destination unless you know where you’re heading. Yet only 54% of workers or their spouses have tried to estimate the savings they would need to live comfortably in retirement.1

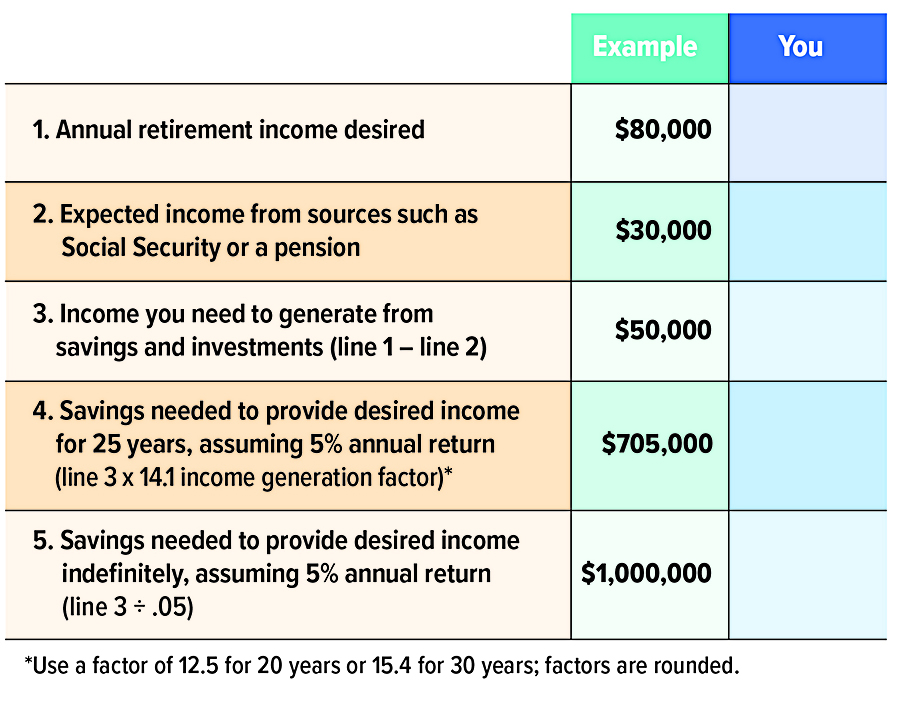

To get a start on establishing a retirement savings goal, use the simple worksheet on this page to compare the income you think you will need (or want) with the sources of income you expect. Keep in mind that estimates are in today’s dollars, so your desired income should account for the rising cost of living between now and the time you plan to retire.

How much will you need?

Everyone’s situation is different, but one common guideline is that you will need at least 70% to 80% of your pre-retirement income to meet your retirement expenses. This assumes that you will have paid off your mortgage, will have lower transportation and clothing expenses when you stop working, and will no longer be contributing to a retirement savings plan.

Although some expenses may be lower, others might increase, depending on your retirement lifestyle. For example, you may want to travel more or engage in new activities.

Unfortunately, medical expenses will likely be higher as you age. A recent study suggests that a man, woman, or couple who retired in 2024 at age 65 — with median prescription drug expenses and average Medigap premiums — might need $191,000, $226,000, or $366,000 in savings, respectively, to cover retirement health-care expenses (not including dental, vision, or long-term care).2 Future retirees may need even higher levels of savings.

Estimate income sources

You can estimate your monthly Social Security benefit at different retirement ages by establishing a my Social Security account at ssa.gov/myaccount. The closer you are to retirement, the more accurate this estimate will be. If retirement is many years away, your benefit could be affected by changes to the Social Security system, but it might also rise as your salary increases and the Social Security Administration makes cost-of-living adjustments.

If you expect a pension from current or previous employment, you should be able to obtain an estimate from the employer.

Add other sources of income, such as from consulting or a part-time job, if that is in your plans. Be realistic. Consulting can be lucrative, but part-time work often pays low wages, and working in retirement is less likely than you might expect. In 2025, 75% of workers expected to work for pay after retirement, but only 29% of retirees said they had actually done so.3

Get Started

This worksheet might give you a general idea of the savings needed to generate your desired retirement income.

This hypothetical example does not account for taxes or inflation and is used for illustrative purposes only. Rates of return will vary over time, particularly for long-term investments. Actual results will vary.

The income from your savings may depend on unpredictable market returns and the length of time you need your savings to last. Higher returns could enable your nest egg to grow faster, but it would be more prudent to use a modest rate of return in your calculations. Remember that all investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful. Investments seeking higher rates of return also involve a higher degree of risk.

A more detailed projection

A rough estimate of your retirement savings goal is a good beginning, and a professional assessment may be the next step. Although there is no assurance that working with a financial professional will improve investment results, a professional can evaluate your objectives and resources and help you consider appropriate long-term financial strategies.

1–3) Employee Benefit Research Institute, 2025 (Health-care expenses include Medigap premiums, Medicare Part B premiums and deductibles, Medicare Part D premiums, and out-of-pocket prescription drug expenses; projection is based on a 90% chance of meeting expenses and assumes a 7.32% return on savings from age 65 until expenditures are made.)

This content has been reviewed by FINRA.

Prepared by Broadridge Advisor Solutions. © 2025 Broadridge Financial Services, Inc.

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Osaic Wealth Inc., Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Strickland Financial Group is not affiliated with S&S Wealth Management, LP.

This communication is strictly intended for individuals residing in the state(s) of TX, NE, OK and FL. No offers may be made or accepted from any resident outside the specific states referenced.