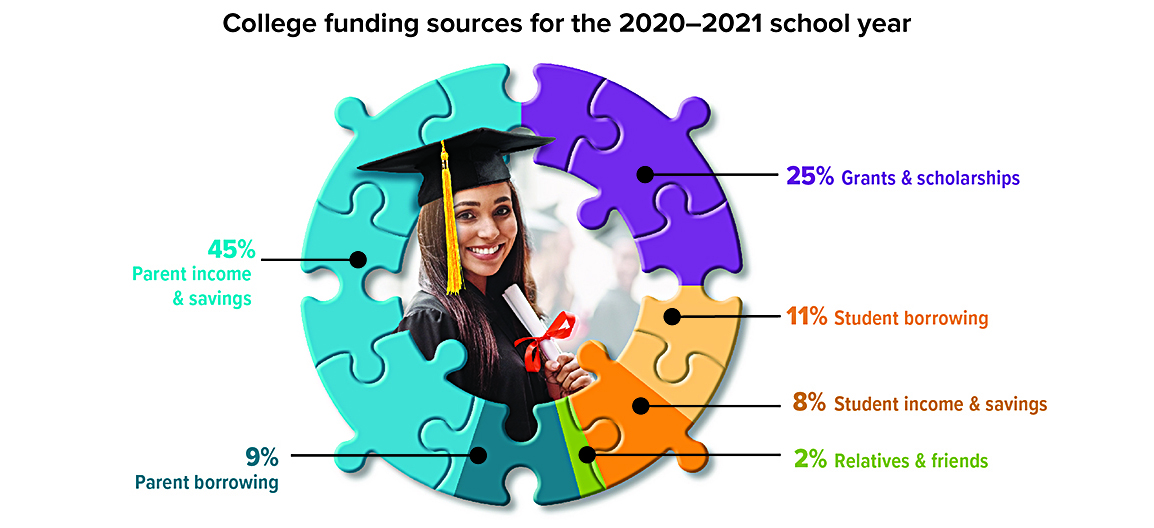

The typical family uses a combination of income, savings, borrowing, and grants/scholarships to pay for college. Not surprisingly, the largest source of funding — 45% — comes from parents in the form of current income and savings.

Starting a college fund as early as possible and aggressively looking for grant aid at college time can help families reduce the amount they may need to borrow, giving students greater flexibility when making decisions. Colleges are usually the best source of grant aid. A net price calculator (available on every college website) can help students estimate how much grant aid they might receive at specific colleges.

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2022.