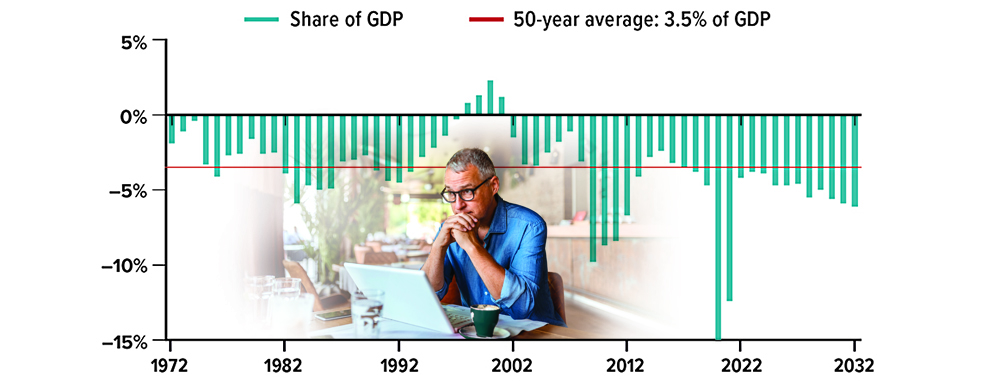

After record federal budget deficits of $3.1 trillion in 2020 and $2.8 trillion in 2021, the 2022 deficit is projected to drop to $1.0 trillion, due to increased tax revenue from a stronger economy and the end of government pandemic-relief spending. These deficits are equivalent to 15.0%, 12.4%, and 4.2% of gross domestic product (GDP), respectively. For comparison, the deficit averaged 3.5% of GDP over the last 50 years.

The deficit is expected to drop further in 2023 before rising steadily due to increasing health-care costs for an aging population and higher interest rates on mounting government debt. In 2032, the deficit is projected to be almost $2.3 trillion, equivalent to 6.1% of GDP.

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2022.