The importance of proper estate planning cannot be overstated, regardless of the size of your estate or the stage of life you’re in. Nevertheless, it’s surprising how many American adults haven’t put a plan in place.

You might think that those who are rich and famous would be way ahead of the curve when it comes to planning their estates properly. Yet plenty of celebrities and people of note have died with inadequate or nonexistent estate plans.

Michael Jackson

The king of pop died in June 2009 with an estate worth an estimated $600 million. Jackson had prepared an estate plan that included a trust. However, he failed to fund the trust with assets prior to his death — a common misstep when including a trust as part of an estate plan. While a properly created and funded trust generally avoids probate, an unfunded trust almost always requires probate. In this case, Jackson’s trust beneficiaries had to make numerous filings with the probate court in order to have the judge transfer assets to the trust. This process added significant costs and delays, and made what should have been a private matter open to the public.

Trusts incur upfront costs and often have ongoing administrative fees. The use of trusts involves a complex web of tax rules and regulations. You should consider the counsel of an experienced estate planning professional and your legal and tax professionals before implementing such strategies.

James Gandolfini

When the famous Sopranos actor died in 2013, his estate was worth an estimated $70 million. He had a will, which provided for various members of his family. However, his estate plan did not include proper tax planning. As a result, the Gandolfini estate ended up paying federal and state estate taxes at a rate of 55%. This situation illustrates that a carefully crafted estate plan addresses more than just the distribution of assets. Taxes and other expenses could be reduced, if not eliminated altogether, with proper planning.

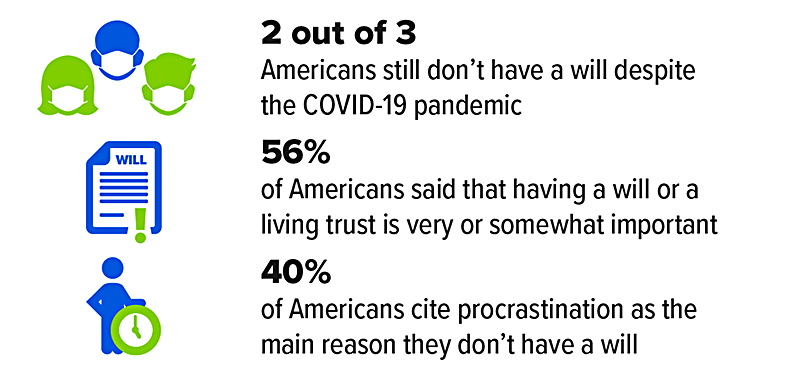

Americans Are Putting Off Estate Planning

Prince

Prince Rogers Nelson, better known as Prince, died in 2016. He was 57 years old, still making incredible music, and entertaining millions of fans throughout the world. The first filing in the Probate Court for Carver County, Minnesota, was by a woman claiming to be his sister, asking the court to appoint a special administrator because no will or other testamentary documents were filed. Since Prince died without a will, the distribution of his over $150 million estate was determined by state law. In this case, a Minnesota judge was tasked with culling through hundreds of court filings from prospective heirs, creditors, and other “interested parties.” The proceeding was open and available to the public for scrutiny.

Barry White

Barry White, the deep-voiced soulful singer, died in 2003 without a will or estate plan. He died while legally married, although he’d been separated from his second wife for many years and was living with a long-time girlfriend. He had nine children. Because he had not divorced his wife, she inherited everything, leaving nothing for his girlfriend or his children. Needless to say, a legal battle ensued.

Heath Ledger

Formulating and executing an estate plan is important. It’s equally important to review your documents periodically to be sure they’re up-to-date. Not doing so could result in problems like those that befell the estate of actor Heath Ledger. Although Ledger had prepared a will years before his death, several changes in his life transpired after the will was written, not the least of which was his relationship with actress Michelle Williams and the birth of their daughter Matilda Rose. The will left nothing to Michelle or Matilda Rose. Fortunately, Ledger’s family later gave all the money to his daughter, but not without some family disharmony.

Florence Griffith Joyner

An updated estate plan works only if the people responsible for carrying out your wishes know where to find these important documents. When Olympic medalist Florence Griffith Joyner died in 1998 at the young age of 38, her family couldn’t locate her will. This led to a bitter dispute between her husband, Al Joyner, and Flo Jo’s mother, who claimed her daughter had promised that she could live in the Joyner home for the rest of her life.

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2022.