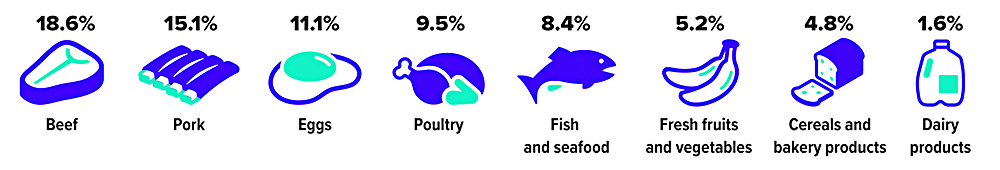

As measured by the Consumer Price Index for food at home, grocery prices increased 3.4% in 2020, a faster rate than the 20-year historical average of 2.4%.1 More recently, food inflation accelerated by 6.5% during the 12 months ending in December 2021, while prices for the category that includes meat, poultry, fish, and eggs spiked 12.5%.2

Food prices have long been prone to volatility, in part because the crops grown to feed people and livestock are vulnerable to pests and extreme weather. But in 2021, U.S. food prices were hit hard by many of the same global supply-chain woes that drove up broader inflation.

The pandemic spurred shifts in consumer demand, slowed factory production in the United States and overseas, and caused disruptions in domestic commerce and international trade that worsened as economic activity picked up steam. A shortage of metal containers and backups at busy ports and railways caused long shipping delays and drove up costs. Severe labor shortages, and the resulting wage hikes, have made it more difficult and costly to manufacture and transport many types of unfinished and finished goods.3

As long as businesses must pay more for the raw ingredients, packaging materials, labor, transportation, and fuel needed to produce, process, and distribute food products to grocery stores, some portion of

these additional costs will be passed on to consumers. And any lasting strain on household budgets could prompt consumers to rethink their meal choices and shopping behavior.

Seven Ways to Master the Supermarket

The U.S. Department of Agriculture expects food inflation to moderate in 2022, but no one knows for certain how long prices might stay elevated.4 In the meantime, it may take more eff ort and some planning to control your family’s grocery bills.

Annual Change in Consumer Price Indexes for Food (through December2021)

• Set a budget for spending on groceries and do your best not to exceed it. In 2021, a typical family of four with a modest grocery budget spent about $1,150 per month on meals and snacks prepared at home. Your spending limit could be higher or lower depending on your household income, family size, where you live, and food preferences.

• To avoid wasting food, be aware that food date labels such as “sell by,” “use by,” and “best before” are not based on safety, but rather on the manufacturer’s guess of when the food will reach peak quality. With fresh foods like meat and dairy products, you can usually add five to seven days to the “sell by” date. The look and smell can help you determine whether food is still fresh, and freezing can extend the shelf life of many foods.

• Grocery stores often rotate advertised specials for beef, chicken, and pork, so you may want to plan meals around sale-priced cuts and buy extra to freeze for later. With meat prices soaring, it may be a good time to experiment with “meatless” meals that substitute plant-based proteins such as beans, lentils, chickpeas, or tofu.

• Stock up on affordable and nonperishable food such as rice, pasta, dried beans, canned goods, and frozen fruits and vegetables when they are on sale.

• Select fresh produce in season and forgo more expensive pre-cut and pre-washed options.

• Keep in mind that a store’s private-label brands may off er similar quality at a significant discount from national brands.

• Consider joining store loyalty programs that off er weekly promotions and personalized deals.

1, 4–5) U.S. Department of Agriculture, 2021

2) U.S. Bureau of Labor Statistics, 2022

3) Bloomberg Businessweek, September 15, 2021

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2022.