A growing number of Americans are going “cashless” for everyday purchases like groceries, gas, services, and meals compared to previous years. A cashless payment might be made using a debit or credit card, or a payment app or mobile wallet on a smartphone.

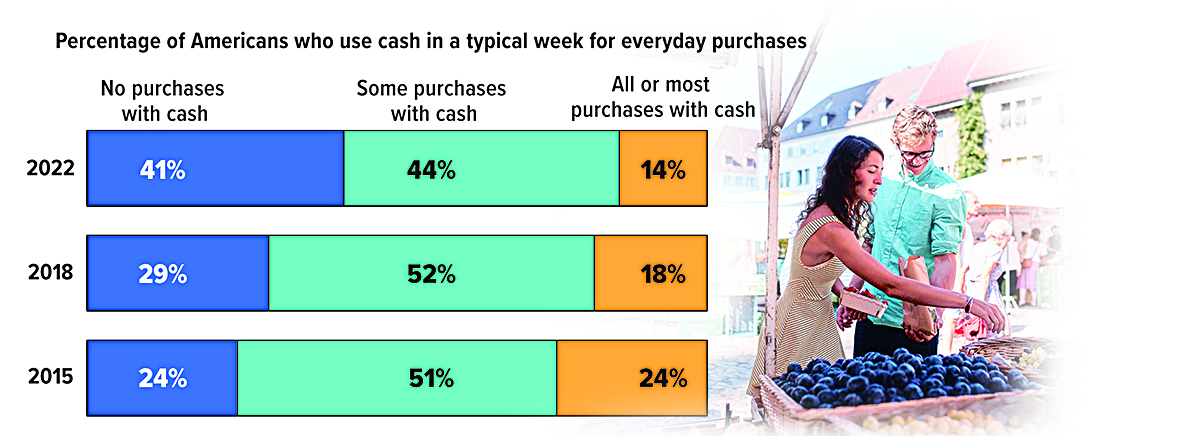

In 2022, about 41% of Americans said none of their purchases in a typical week were paid for using cash, up from 29% in 2018 and 24% in 2015. Among affluent households, 59% said they didn’t use cash for any typical weekly purchases. The trend of not carrying cash varies by age, with 54% of people under age 50 saying they don’t worry much about whether they have cash on hand compared to 28% of people 50 and older.

Source: Pew Research Center, 2022 (numbers do not equal 100% due to rounding)

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2023.