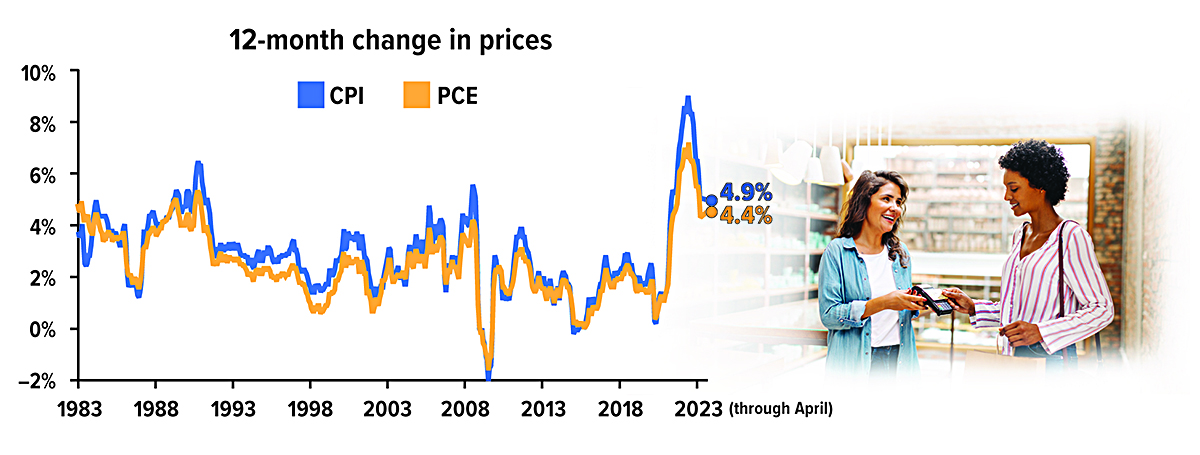

Economists and investors rely on the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index to track the path of inflation over time. The two indexes use different formulas and data sources — CPI gets data from consumers and PCE data comes from businesses. PCE is broader in scope and some expenditure categories are weighted very differently. In late 2022, the difference between annual inflation as measured by CPI and PCE was the widest it has been since the 1980s.

Source: U.S. Bureau of Labor Statistics, 2023, U.S. Bureau of Economics Analysis, 2023 (data through April 2023)

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2023.