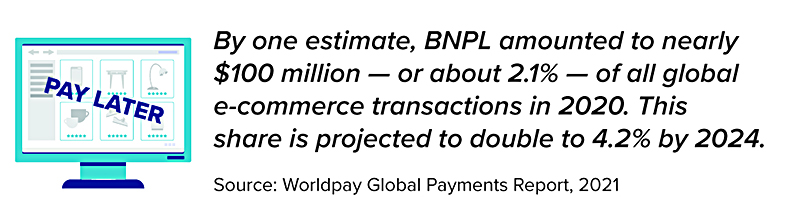

If you shop online, you might have noticed a growing number of buy now, pay later (BNPL) services that offer the option to spread out the payments on your purchases. Buyers who make one partial payment upfront and agree to several additional interest-free installments can receive their orders right away. This is a key difference from the layaway plans of the past: Shoppers had to wait until the balance was paid to take their goods home. Many stores discontinued layaway plans in the 1980s when the use of credit cards became widespread.

BNPL plans are more popular with younger consumers trying to stretch their paychecks, partly because they are more comfortable shopping online (and particularly on smartphones). At first glance, it may seem like a worthwhile convenience, but there are good reasons to think twice before committing to installment purchases.

Credit Is Credit

BNPL plans are essentially point-of-sale loans. Applying for the financing is quick and easy, which seems like a plus when time is tight.

However, speedy access to credit also provides instant gratification and allows for more impulse buying. It might tempt you to overspend on things you don’t really need and probably wouldn’t buy if you had to save up and/or pay 100% of the cost upfront. And if you make a lot of smaller purchases across multiple services, it may be harder to keep track of how much you are actually spending.

In fact, one criticism of BNPL services is that they make it easier for consumers to fall into debt. As with credit cards, you would face financial consequences such as late fees and/or high interest rates if you encounter a financial setback and can’t pay the installments on schedule.

Another point to consider is that credit-card companies report on-time payments to the credit bureaus, so using credit cards responsibly can help you build a positive credit history. In contrast, some BNPL lenders may not bother to report on-time payments — though they will surely report missed payments and collections. Before you use any BNPL service, read the fine print carefully to make sure you understand the terms and conditions and the company’s credit reporting policies.

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2022.