Combining finances can be complicated for any couple, but the challenges become more complex the second time around, especially when children are involved. Here are some ideas to consider if you are already part of a blended family or looking forward to combining households sometime soon.

Be Clear and Comprehensive

It’s important to reveal all assets, income, and debts, and discuss how these should be treated in your combined family. A prenuptial agreement may seem unromantic, but it could prevent acrimony and misunderstanding if the marriage ends through divorce or the death of a spouse. If you don’t want a legal agreement, have an open and honest discussion, and lay all your cards on the table. It’s not too late to clarify the situation after you’ve tied the knot.

One of the most fundamental issues is where you and your new spouse will live. It might be more convenient — and perhaps better financially — to move into a residence that one of you already owns. But couples in a second marriage often report that moving into a new home gives them a feeling of a fresh start, which could have value that can’t be measured financially.1

Create a blueprint for short-term and long-term finances. Do you plan to combine bank accounts or keep separate accounts, perhaps with a joint account to pay shared expenses? To what accounts will each of your salaries be deposited? Will one spouse help pay off the other spouse’s debts such as student loans, auto loans, and credit cards? Research suggests that remarried couples are generally happier when they pool resources, but there are many variations in how that might be carried out.2

Consider the Kids

Discuss how you plan to handle financial responsibility for children from previous marriages versus any children you have together. Are they going to be “your kids, my kids, and our kids,” or are they all “our kids”? Being a stepparent and/or a divorced parent can be complex emotionally, and there are no easy answers. But there are some not-so-complex financial questions you should address up front.

Be clear about alimony payments, child support, and other financial responsibilities. For example, what is each spouse’s intention and/or legal obligation to pay college tuition costs for children from a previous marriage? Are there assets that one spouse wants to reserve for the benefit of his or her children? Is the other spouse willing to waive rights to those assets?

Communicating and planning with an ex-spouse is essential if you share custody of children. Along with responsibilities for everyday expenses, be sure you understand and agree on other financial issues, such as who will claim the child as a beneficiary on tax returns, and who is the “custodial parent” for purposes of financial aid applications. A beneficiary deduction may be more valuable for a parent with higher earnings, but a custodial parent with lower earnings may enable a student to qualify for more financial aid.

I Do, I Do

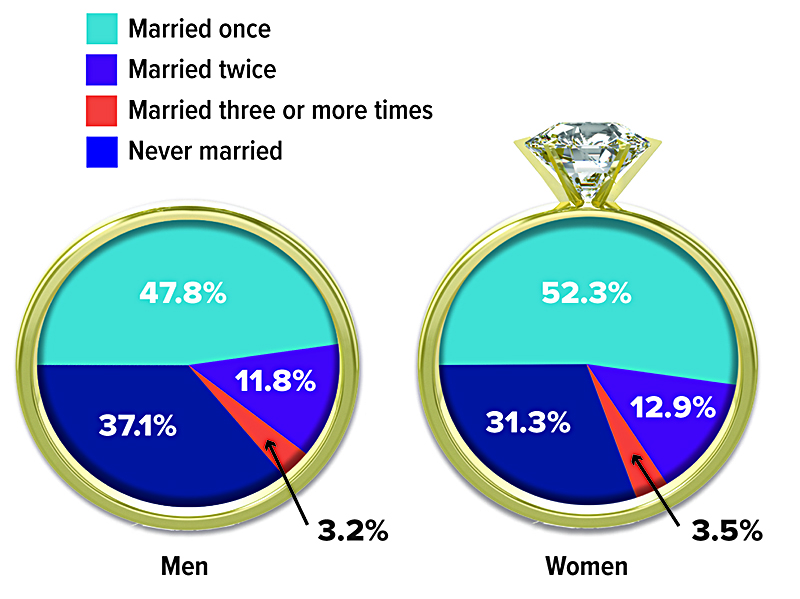

Roughly two out of three Americans ages 15 and older have been married at least once, and a substantial number have been married more than once.

Update Wills and Beneficiary Forms

Be sure that your will and all beneficiary forms reflect your new situation and current wishes. A will can designate heirs and facilitate distribution of assets when an estate goes through the probate process. However, the assets in most pension plans, qualified retirement accounts, and life insurance policies convey directly to the people named on the beneficiary forms — even if they are different from those named in your will — and are not subject to probate. By law, your current spouse is the beneficiary of an ERISA-governed retirement account such as a 401(k) plan. If you want to designate an ex-spouse or children from a previous marriage as account beneficiaries, you must obtain a notarized waiver from your current spouse.

Blending families can be challenging on many levels. Financial matters may be easier to deal with than personal aspects as long as you take appropriate steps to identify the issues and agree on your shared financial goals.

1–2) American Psychological Association, August 23, 2019 (most current information available)

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2023.