As a child, you may have dreamed about finding buried treasure, but you probably realized at an early age that it was unlikely you would discover a chest full of pirate booty. However, the possibility that you have unclaimed funds or other assets waiting for you is not a fantasy.

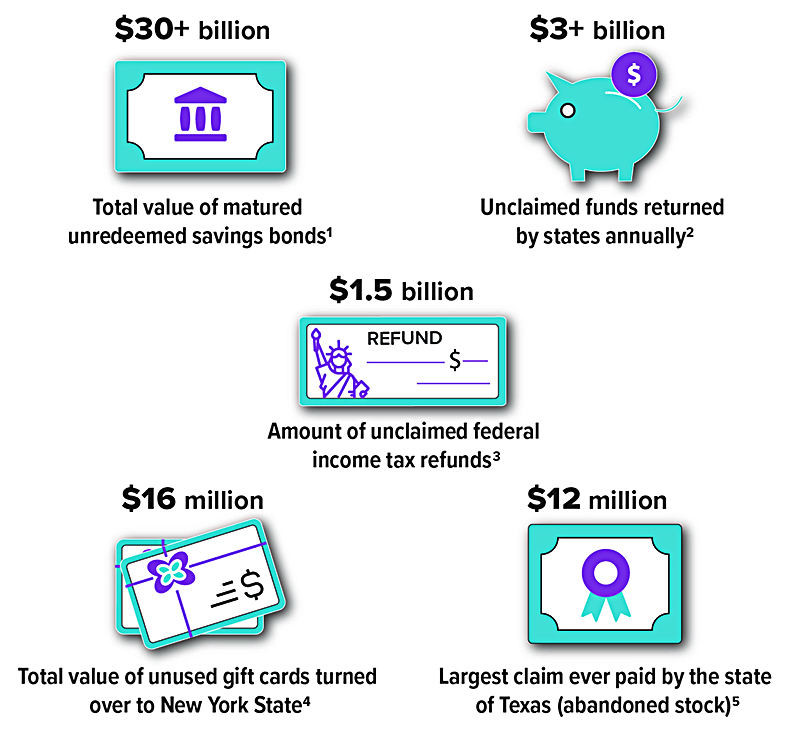

Billions of dollars in unclaimed property are reported each year, and 10% of people have some form of property waiting to be returned by state unclaimed property programs.1 So how do you find what is owed to you, even if it’s not a fortune? One of the challenges of finding lost property is knowing where to look.

State Programs

Every state has an unclaimed property program that requires companies and financial institutions to turn inactive account assets over to the state if they have lost contact with the rightful owner for a period of time. In most states, this dormancy period is three to five years, but may be shorter or longer depending on the type of property and on state law. It then becomes the state’s responsibility to locate the owner.

For state programs, unclaimed property might include financial accounts, stocks, uncashed dividends and payroll checks, utility security deposits, insurance payments and policies, trust distributions, mineral royalty payments, gift cards, and the contents of safe-deposit boxes. State-held property generally can be claimed in perpetuity by original owners and heirs.

Most states participate in a free national database sponsored by the National Association of Unclaimed Property Administrators called MissingMoney.com. You might also check specific databases for every state where you have lived. For more information and links to individual state programs, see the National Association of Unclaimed Property Administrators at unclaimed.org.

Even if your search isn’t fruitful the first time you look, check back often because states regularly update their databases.

Federal Programs

Unclaimed property held by federal agencies might include tax refunds, pension funds, funds from failed banks and credit unions, funds owed investors from U.S. Securities and Exchange Commission enforcement cases, refunds from mortgages insured by the Federal Housing Administration, and matured unredeemed savings bonds. There is no single searchable database for federal agencies, but you can find more information and links to sites you can search at usa.gov/unclaimed-money.

Submitting a Claim

To claim property, follow the instructions given, which will vary by the type of asset and where the property is held. You’ll need to verify ownership, typically by providing information about yourself (such as your Social Security number and proof of address), and submit a claim form either online or by mail. What if the listed property owner is deceased? A claim may be made by a survivor and will be payable according to state or federal law.

Avoiding Scams

Finding and receiving any unclaimed property to which you are entitled should not cost you money. Some states allow legitimate third-party “finders” to offer to help rightful owners locate property for a fee, but you do not need to pay them in order to receive the property. Be on the lookout for scammers who pretend to have unclaimed property in order to trick you into revealing personal or financial information. Before you sign any contracts or give out any information, contact your state’s unclaimed property office.1) National Association of State Treasurers, 2022

The articles and opinions expressed in this document were gathered from a variety of sources, but are reviewed by Strickland Financial Group, LLC prior to its dissemination. Any articles written by Graham M. Strickland or Strickland Financial Group will include a ‘by line’ indicating the author. Strickland Financial Group provides a full range of financial services, including but not limited to: life, health, disability and long term care insurance, group and individual retirement plans and individual investments. Receipt of literature in no way implies suitability of product(s) in your financial plan. Strickland Financial Group maintains networking relationships with estate planning attorneys and tax professionals but does not itself offer legal or tax advice. Securities offered through Triad Advisors, LLC (TRIAD), Member FINRA/SIPC. Advisory services offered through S&S Wealth Management, LP (S&S). A Registered Investment Advisor. Strickland Financial Group is independent of TRIAD and S&S.

This communication is strictly intended for individuals residing in the state(s) of NE and TX. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2022.